Usually done to reserved products that have high social costs, such as tobacco or liquors which is called Excise Tax.

What is Excise Tax in Canada?

There are two types of federal levies on products manufactured or produced in Canada: excise taxes and excise duties. These levies are applied to a limited range of goods at different rates and in different ways, depending on the product.Excise tax and excise duty apply to goods before the GST/HST is added.

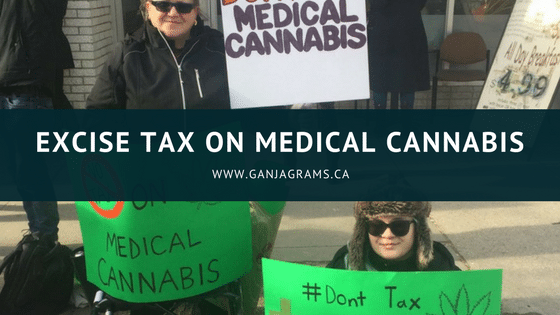

Medical Cannabis rarely covered by insurers. Now and then, it’s a talk of the town that affordability is an ongoing barrier accessing medical cannabis.

Some attempts to fill the gap by ‘Compassionate Pricing” or “Discount Prices” which was offered mostly by Licensed cannabis producers; however it’s not enough. It only makes the medical cannabis less accessible to people who need it as the cost will rise and would make every medical marijuana increase its price.

Currently, medical cannabis is subject to sales tax, which others treat as prescribed medication. The decision to filter low-THC and CBD products from the excise tax list of marijuana.

As a medical cannabis patient, maybe young or old. These will only mean trying a different type of products which are expensive for them to avail.

Canadian Government attempts to frame the Low THC for saving medical cannabis patients money, but the reality is they are merely adding excise taxes on each product that should not be a tax.

The process of searching what works has its burden. What will the patients do when they purchased cannabis which does not suit them?

It would be nothing! The estimated cost is around $60 to 90$ for one bottle of oil or strains but because of most producers do not offer such method for any returned used cannabis products.

It’s already complicated and unstable system which is the burden to sick patients and their families, especially with additional tax.

It is wrapped with ideas of stigma and distrust of its potential as medicine. Unlike the “recreational” use of marijuana.

We should encourage responsible access to medical cannabis, rather than exacerbate issues around access, affordability and coverage.

Furthermore, there’s have been a conversation around the government with this measures that used as a way of ensuring Canadians not abusing the access to medical cannabis system.

The insinuation that Medical Cannabis patients are targeting with this and try to “scam the system”.

Moreover, individuals go through the hassle of coping up a fake diagnosis, visit their doctors and of the try few alternative medicines first before getting medical information and renewing it for every 12 months, just to save tax? That would be a hassle and for me, why would I do that just to avoid %?

Seriously, there is no logical reason to impose an excise tax on any medical cannabis. In which, removing the existing tax on medical cannabis would make a difference![/vc_column_text][/vc_column][/vc_row]

I didn’t realize there would bee a difference between medicinal and recreational cannabis? But I am very worried when consumers accept a shoddy product as safe for consumption. Especially when it is not grown with healing or medical motive.